Easing the High Cost of Living for Seniors and the Disabled

Everyone knows the cost of living is rising. Businesses adjust by raising prices and improving efficiencies. Working families struggle, but maybe work a little longer or pick up a second job or part time business. Some may pass on a costly vacation.

But what about folks on a fixed income? What can seniors and those on disabilities do to deal with rising costs straining their limited income? Oregon has a limited program in place, called the Property Tax Deferral System, that can help. But we can and should broaden that program by amending Oregon’s Constitution to place a cap on property tax increases for senior citizens and people with disabilities.

But what about folks on a fixed income? What can seniors and those on disabilities do to deal with rising costs straining their limited income? Oregon has a limited program in place, called the Property Tax Deferral System, that can help. But we can and should broaden that program by amending Oregon’s Constitution to place a cap on property tax increases for senior citizens and people with disabilities.

We can and should broaden that program by amending Oregon’s Constitution to place a cap on property tax increases for senior citizens and people with disabilities.

Oregon’s Property Tax Deferral System

Oregon already allows seniors and people with disabilities to defer property taxes under certain circumstances. You can read more about this at: https://www.oregon.gov/dor/programs/property/SiteAssets/Pages/deferral/deferral-disabled-senior_490-015-1.pdf

The State describes it like this:

As a disabled or senior homeowner, you can borrow from the State of Oregon to pay your property taxes to the county.

If you qualify for the program, Oregon Department of Revenue will pay your county property taxes on November 15 of each year. To participate, you must file an application with the county assessor either by April 15, or file late from April 16 to December 1 and pay a fee.

A lien will be placed on your property, and the State will become a security interest holder. Upon disqualification or cancellation from the program, the following must be repaid in full before the lien or security interest on the property will be released:

Oregon already allows seniors and people with disabilities to defer property taxes under certain circumstances. You can read more about this at: https://www.oregon.gov/dor/programs/property/SiteAssets/Pages/deferral/deferral-disabled-senior_490-015-1.pdf

The State describes it like this:

As a disabled or senior homeowner, you can borrow from the State of Oregon to pay your property taxes to the county.

If you qualify for the program, Oregon Department of Revenue will pay your county property taxes on November 15 of each year. To participate, you must file an application with the county assessor either by April 15, or file late from April 16 to December 1 and pay a fee.

A lien will be placed on your property, and the State will become a security interest holder. Upon disqualification or cancellation from the program, the following must be repaid in full before the lien or security interest on the property will be released:

- Your property taxes that have been paid by Department of Revenue.

- The accrued interest (6 percent annually).

- The cost of recording and releasing the lien.

Therefore, back property taxes, with interest at 6%, accrue until the property is sold or the property owner passes away. Because of the State’s lien on the property, it gets repaid the accrued amounts, either out of sale proceeds or by the estate of the deceased – which may mean the estate must sell the property, thus losing the generational property transfer opportunity. The good news is that allproperty taxes can be deferred and eventually repaid out of the equity in the home.

There are conditions to an applicant’s eligibility for the deferral program. By April 15 of a given year, deferral applicants must meet all the following requirements:

1. Applicants must be either: 62 years old or older, or disabled and receiving or eligible to receive federal Social Security Disability benefits.

2. Applicants must own the property and have a recorded deed in their name.

3. Applicants must have both owned and lived on the property for at least the last five years, unless there is a health-related waiver.

4. With certain conditions, if the applicant hasn’t lived in and owned their home for the last five years, they may still qualify for the program if they downsized.

5. Homeowners insurance must be in place that covers fire and other casualty.

6. Household income must not exceed the annual limit (2022 limit is $51,000). Household income includes all taxable and non-taxable income of the applicant(s) and spouse(s) that resided in the home for the previous year.

7. Applicant’s net worth must be less than $500,000. This doesn’t include the value of the home under the Property Tax Deferral program or personal property.

8. With limited exceptions, applicants don’t have a reverse mortgage.

9. The real market value of the applicant’s home as shown on the 2021-22 tax statement is less than the limit allowed by statute (see the table at www.oregon.gov/dor).

Oregon’s Seniors and People with Disabilities Need More Help

Not all seniors or disabled people who might qualify for the deferral program are unable to pay their current property taxes. Not all will want to accrue a debt that encumbers the property. However, as property taxes rise along with the extraordinary inflationary pressures driving cost of living, this can pose a problem for those on a fixed income. This is a problem that the State could easily address by allowing for a senior and disabled Property Tax Cap.

We could simply freeze property taxes at the level they’re at when the homeowner applies for the Tax Cap. Applicants would have to meet the same or similar conditions as set forth in the Property Tax Deferral Program. Counties would still receive property tax revenue from Tax Cap participants, so the short-term benefit to the counties is better than under the deferral program. The impact on property tax revenue by freezing taxes required of senior and the disabled will be more than offset by the inflation-devalued ultimate payment of the taxes years down the road, since the State keeps the interest on the loan.

There are conditions to an applicant’s eligibility for the deferral program. By April 15 of a given year, deferral applicants must meet all the following requirements:

1. Applicants must be either: 62 years old or older, or disabled and receiving or eligible to receive federal Social Security Disability benefits.

2. Applicants must own the property and have a recorded deed in their name.

3. Applicants must have both owned and lived on the property for at least the last five years, unless there is a health-related waiver.

4. With certain conditions, if the applicant hasn’t lived in and owned their home for the last five years, they may still qualify for the program if they downsized.

5. Homeowners insurance must be in place that covers fire and other casualty.

6. Household income must not exceed the annual limit (2022 limit is $51,000). Household income includes all taxable and non-taxable income of the applicant(s) and spouse(s) that resided in the home for the previous year.

7. Applicant’s net worth must be less than $500,000. This doesn’t include the value of the home under the Property Tax Deferral program or personal property.

8. With limited exceptions, applicants don’t have a reverse mortgage.

9. The real market value of the applicant’s home as shown on the 2021-22 tax statement is less than the limit allowed by statute (see the table at www.oregon.gov/dor).

Oregon’s Seniors and People with Disabilities Need More Help

Not all seniors or disabled people who might qualify for the deferral program are unable to pay their current property taxes. Not all will want to accrue a debt that encumbers the property. However, as property taxes rise along with the extraordinary inflationary pressures driving cost of living, this can pose a problem for those on a fixed income. This is a problem that the State could easily address by allowing for a senior and disabled Property Tax Cap.

We could simply freeze property taxes at the level they’re at when the homeowner applies for the Tax Cap. Applicants would have to meet the same or similar conditions as set forth in the Property Tax Deferral Program. Counties would still receive property tax revenue from Tax Cap participants, so the short-term benefit to the counties is better than under the deferral program. The impact on property tax revenue by freezing taxes required of senior and the disabled will be more than offset by the inflation-devalued ultimate payment of the taxes years down the road, since the State keeps the interest on the loan.

|

The beneficiaries obviously are the senior and disabled homeowners who retain their equity, their dignity and get a small, but meaningful break on living expenses. It’s also a nice acknowledgement by all of us of the value of these people in our society and the taxes they have paid to support us all for many, many years. Now, as they are struggling, we can easily afford to give them a break. Secondary beneficiaries are the heirs, who can receive a property unencumbered by property tax debt.

This seems like a winning proposition for all. Hopefully the legislature will see it the same way in the coming session. |

It’s also a nice acknowledgement by all of us of the value of these people in our society and the taxes they have paid to support us all for many, many years. Now, as they are struggling, we can easily afford to give them a break. Secondary beneficiaries are the heirs, who can receive a property unencumbered by property tax debt. |

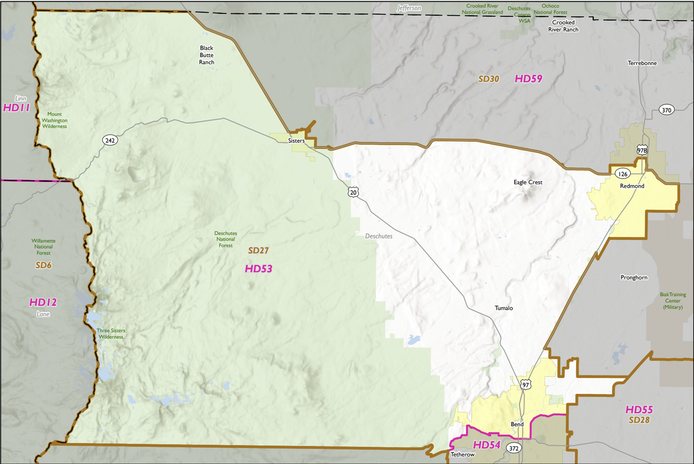

(to help elect Michael Sipe, Republican Candidate for Oregon House District 53)